In July, as detailed in a recent report released by the Secretariat of Mining, companies within Argentina's mining project portfolio achieved a trade surplus of US$134 million, representing a year-on-year decline of 43.3%. This result reflects mining exports totaling US$226 million against imports of US$91 million. As such, the exports of these companies were more than double their imports. In the first seven months of 2024, the cumulative trade balance of these companies showed a surplus of US$1.434 billion, although this represents a 14.9% decrease compared to the same period of the previous year.

By Panorama Minero

In July 2024, exports from 18 mining projects in production amounted to US$225 million, marking a year-on-year decline of 37.1%. This figure accounted for 92.2% of the country’s total mining exports for the month. Three key products comprised 98.5% of these exports: gold was the most significant, contributing 67.7% (US$153 million), followed by silver at 16.6% (US$37 million), and lithium, accounting for 14.2% (US$32 million).

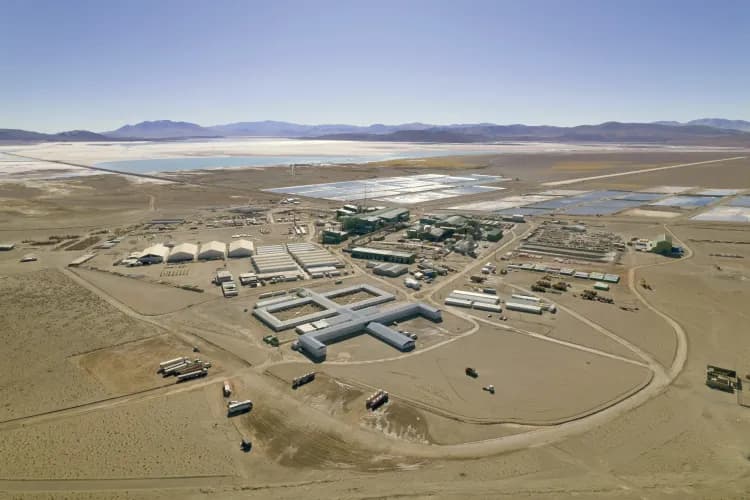

On the import side, mining companies acquired goods totaling US$91 million in July 2024, a 25.1% decrease compared to the same month in 2023. Of this total, 59.3% (US$54.2 million) came from six projects in the construction phase, including one copper and five lithium projects. Projects in production accounted for US$32.2 million (35.2% of the total), comprising four lithium projects, eight gold projects, and three silver projects.

Regarding the use of imports in July, 54.1% (US$49.4 million) was allocated to capital goods, 31.2% (US$28.5 million) to intermediate goods, and 12% (US$11 million) to parts and accessories for capital goods. The remaining 2.7% (US$2.5 million) was spent on fuels and consumer goods.

Imports/Exports Ratio

The ratio of mining imports to exports in July 2024 was 40.5%, higher than the 34% recorded in the same month of 2023. For the first seven months of the year, this ratio reached 32.4%, meaning that for every US$100 exported, mining companies imported approximately US$32. This figure is higher than the 24.2% ratio registered for the same period in 2023.

By mineral type, metal projects (zinc, copper, gold, silver, and uranium) showed an imports/exports ratio of 22.3% in July, while the cumulative figure for the first seven months was 12.2%. In contrast, lithium projects—including those in production, expansion, and construction phases—reported a ratio of 148.9% in July and 138.9% for the cumulative year. This reflects the growing demand for imports in lithium projects due to ongoing expansions and new constructions.