Blue Sky Uranium announced an agreement with Corporación América, the group led by businessman Eduardo Eurnekian, to advance the Ivana uranium deposit to feasibility stages and then to commercial production. The venture is located in Río Negro and is one of Argentina’s most recognized projects related to the gray metal.

By Panorama Minero

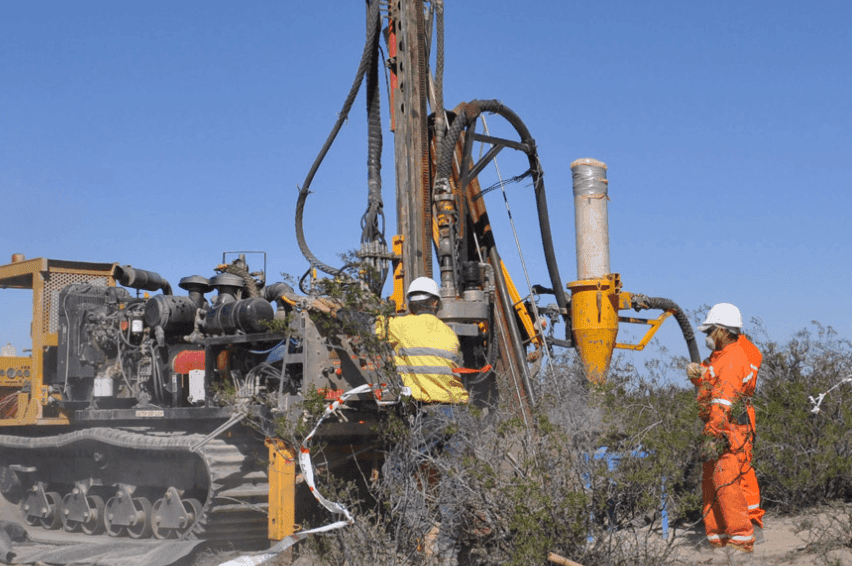

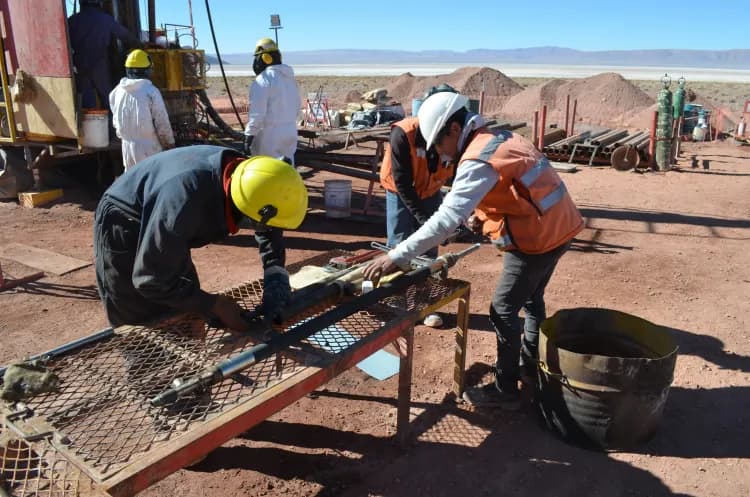

Minera Cielo Azul, the local subsidiary of Blue Sky Uranium, has reached a significant preliminary agreement for the development of its main project, the Ivana uranium deposit, aiming to accelerate the production of this new mining center. This progress promises to generate social and economic development opportunities for both the local community and Argentina, with long-term investments and the possibility of achieving self-sufficiency in uranium for clean energy generation.

The proposal, which has not yet been formalized into a definitive agreement, involves the collaboration between Blue Sky Uranium (BSK), part of the Grosso Group, and Corporación América (COAM), one of the country’s most prominent economic groups with extensive experience in energy and mining. Grosso Group, a pioneer in mining exploration in Argentina since 1993, has achieved four significant discoveries to date, two of which are already in operation. COAM, on the other hand, has invested in energy and mining for over a decade.

The primary goal of this agreement is to make the Ivana uranium deposit, located in the province of Río Negro, viable and bring it to commercial production. Additionally, investments will be made in exploring surrounding areas to identify new deposits that could extend the project’s productive life. The recent Preliminary Economic Assessment (PEA) of the Ivana deposit indicates a production potential of 17 million pounds of uranium, enough to meet Argentina’s clean energy needs for over 40 years. Currently, the country imports 100% of the uranium and vanadium it consumes.

The Ivana deposit stands out for its globally competitive operating costs and strategic location in a province with extensive experience in nuclear development, supported by renowned institutions such as the Balseiro Institute and INVAP. Additionally, the industrialization processes are expected to be environmentally and community-friendly, with a predominantly local workforce.

The Ivana project will be structured as a joint venture between BSK and COAM, where COAM can achieve 50% control by investing US$35 million in different stages, focused on reaching pre-feasibility and economic feasibility milestones. COAM could increase its stake to 80% by assuming 100% of the investment necessary to reach commercial production. Moreover, COAM plans to invest in exploring a vast region surrounding the Ivana deposit, with the goal of discovering and eventually integrating new deposits into the future production center, thereby extending the project's productive life.

The definitive agreement will be signed after the pertinent audits and the organization of the new strategic alliance, which promises to be a significant milestone in Argentina’s mining and energy development.