The golden metal is the leading actor in Argentina's mining exports. Its future is largely tied to copper.

By Alejandro Colombo

A Meteoric Rise

The year that is soon to conclude has witnessed an unprecedented speed in the revaluation of gold: from US$2,067.55 per ounce recorded on January 2nd at the LBMA (London Bullion Market Association) to US$2,567.30 per ounce on November 15th, the ounce of the golden metal has gained approximately 24%. Before the U.S. presidential elections, the metal had reached figures around US$2,777.80 (Chart 1). This decline of over 8%, around US$200 in nominal terms, could be linked to the monetary policies that Donald Trump may implement upon returning to the White House. In any case, gold has gained more than 45% in two years, increasing by about US$800 per ounce in nominal terms. Ongoing armed conflicts in Ukraine and the Middle East, with no end in sight, reconfirm that gold remains the ultimate safe haven.

Chart 1 – Evolution of the gold ounce price in 2024 (Source: LBMA)

Analysis by the World Gold Council

The World Gold Council (WGC), a leading organization in gold-related information, published its traditional quarterly report, this time covering the period ending September 30th. In this report, it details that the demand for gold (including OTC investment) increased by 5% year-on-year, reaching 1,313 tons, a record for a third quarter, a situation reflected in the gold price, which reached a series of new historical highs during the analysed period, as previously reported. Gold mining production grew by 6% year-on-year, and the cumulative production to date has surpassed the previous high, recorded in 2018. Recycled gold volumes increased by 11% year-on-year, but according to the WGC, a widespread sale due to economic difficulties has not yet been observed. In this regard, the WGC highlighted that the value of demand increased by 35% year-on-year, surpassing US$100 billion for the first time.

In greater detail, the WGC noted that global gold ETF inflows – 95 tons – were the main driver of growth; the third quarter was the first positive one since the first quarter of 2022, with a significant year-on-year change from the large outflows (a drop of 139 tons) in the third quarter of 2023.

A 9% year-on-year decline in investment in bars and coins – 269 tons – was also observed, following a relatively strong third quarter in 2023. Much of the decline was attributed to two or three key markets, countered by a very strong quarter in India. Meanwhile, jewelry consumption – 459 tons – fell by 12% year-on-year, despite strong growth in India. Although consumers bought less, their spending on jewelry increased: the value of demand rose by 13% year-on-year, surpassing US$36 billion.

Regarding central banks, the pace of purchases – 186 tons – slowed in the third quarter, but cumulative purchases for the year remain in line with 2022 and are still widespread.

Finally, artificial intelligence continued to drive the use of gold in technology – 83 tons – registering a 7% year-on-year growth, albeit from a relatively low base. Despite this, the outlook remains cautious.

Two Decades of Notable Changes – China and Russia Replace South Africa and the U.S.

The rise of new players and the decline of historical leaders: this could define the significant shift that has occurred in gold production over the past twenty years, with a supply of 3,000 tons in 2023 compared to 2,600 tons in 2003. As shown in Chart 2, declines in historical producers such as Peru, the U.S., and especially South Africa can be observed. At its peak, South Africa represented more than 70% of global mine supply. This country accounted for 17% of production in 2003; twenty years later, its share is less than 4%. In a similar, though less pronounced, trend, other leaders like Peru – 90 tons produced in 2023 compared to 150 tons in 2003 – and the U.S. – 170 tons produced in 2023 compared to 270 tons in 2003 – have also declined in the global rankings. Together, South Africa, the U.S., and Peru represented 33% of global production – 870 tons – in 2003, but this has fallen to just 12% in 2023, with a combined production of 360 tons.

Chart 2 – Comparison of the main gold producers in 2003 – 2023, measured in tons – (Source: USGS Geological Survey)

Some countries have shown small, but no less important, increases in their gold production, such as Australia and Canada, which together have added 70 additional tons compared to their output in 2003, although their share in percentage terms has remained around 17% of the global total.

Who has emerged to dethrone these countries, while also being direct contributors to the increase in gold production, reaching 3,000 tons in 2023? With increases of 89% and 72% in their gold supply, China and Russia have exponentially grown their share, from about 195 tons to 390 tons, and from 180 tons to 310 tons, respectively. These two countries are the top producers, with a combined supply representing 22% of the global total in 2023 (up from 14% in 2003), compared to the leading producers from 20 years ago – South Africa and the U.S. – which accounted for 28% of the global total in 2023 (down from 9% in 2003), but with positive nominal differences of 450 tons (China and Russia, from 2003 to 2023) and negative differences of 300 tons (South Africa and the U.S., from 2003 to 2023).

In the same way, over the years, there has been an increasing participation of African countries – Mali, Ghana, Tanzania – and Central Asian countries – Kazakhstan and Uzbekistan – with rapidly growing gold output, leading to greater fragmentation and consolidation in the category of "Other Countries."

Gold Resources in Argentina, Following the Pace of Copper Projects

Bajo la Alumbrera marked the D-Day for Argentina's modern mining industry; located in Catamarca province, this project was joined over the years by a series of ventures primarily associated with precious metals, particularly gold, in various regions of Argentina:

• Lindero (Fortuna Mining) in the province of Salta, in the NOA Region

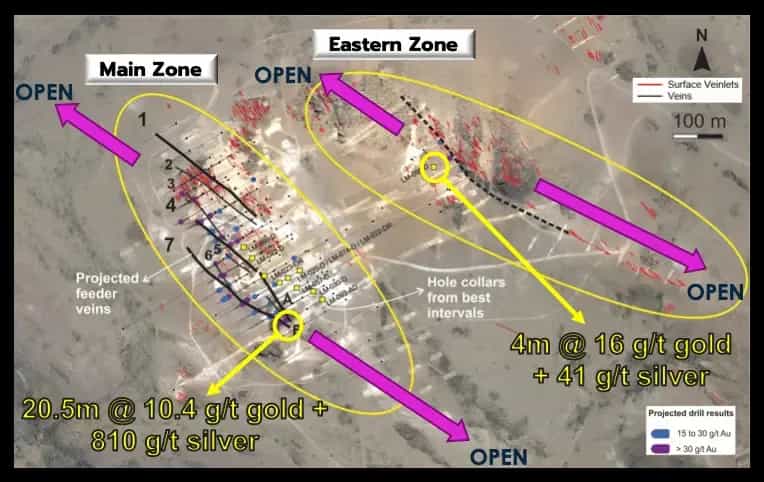

• Several mines located in the Deseado Massif of the province of Santa Cruz, with the profile of being vein-type deposits with high mineral grades; some examples include Cerro Vanguardia (AngloGold Ashanti), Cerro Negro (Newmont), Cerro Moro (Pan American Silver), Don Nicolás (Cerrado Gold), Cap Oeste (Patagonia Gold), not forgetting aggressive exploration campaigns in numerous other ventures

• San Juan province with the mines Veladero (Barrick & Shandong Gold), Gualcamayo (Minas Argentinas), and Casposo (Austral Gold, which is currently in the exploration phase to assess the potential restart of operations based on the determination of new resources)

The 1.26 Moz (35 tons) of gold produced in Argentina in 2023 comes from a dozen establishments where the primary metal is gold.

Despite a decline in production, in nominal terms, gold remains the largest player in Argentina's mining exports: according to information published by the National Mining Secretariat, the yellow metal accounted for 56% of the total (US$2,299 billion out of a total of US$4,060 billion), a share slightly down from previous years (56% in 2022, equivalent to US$2,158 billion from a national total of US$3,857 billion; 61% in 2021, representing US$2,005 billion out of a total of US$3,243 billion; 67% in 2020, representing US$1,763 billion from a national total of US$2,620 billion).

Similarly, it should be noted that gold has been the largest contributor to Argentina's total global exploration budget, averaging 45% over the past ten years, though it declined to 32% in 2023, amounting to around US$137.4 million; in the past year, the exploration budget for gold was surpassed by that of lithium, which accounted for less than 0.5% of Argentina's total.

The National Mining Secretariat has reported a resource of 56.4 Moz of gold from 25 projects in advanced exploration, which would require approximately US$2.872 billion for their construction and production startup. Some of these projects include Hualilán, Lama, Taguas, Del Carmen, and Don Julio in San Juan province; El Dorado-Monserrat, La Josefina, and Las Calandrias in Santa Cruz province; and Calcatreu in Río Negro province.

It is important to highlight the cases of:

• Gualcamayo (San Juan): Through Minas Argentinas S.A., a stepped investment of US$1,000 million has been committed under the RIGI (Large Investment Incentive Regime). This amount will include the development of a new mine from the Carbonatos Profundos deposit, in addition to photovoltaic parks, gas pipeline development for the Jáchal department, and lime production from the limestone resource located at Gualcamayo.

• Hualilán (San Juan): Led by Challenger Gold, this project located in the Ullum department of San Juan province recently obtained its DIA (Environmental Impact Declaration), and the operator is now working on its Prefeasibility study.

• Calcatreu (Río Negro): Developed by Patagonia Gold, this project has been known and feasible for several years and recently received all the permits from provincial authorities to proceed with its construction, development, and production startup.

As for the amount of gold measured in resources and reserves, the largest quantity corresponds to that contained as a by-product of the major copper porphyries in San Juan province – Josemaría, Filo del Sol, Los Azules, Altar – as well as Taca Taca (Salta province) and MARA (Catamarca province) (Table 1).

The potential for Argentina to increase its gold production is significant, either through primary precious metal deposits or, more importantly, as a by-product of copper projects, considering the amount of precious metal contained.