According to a recent report from Argentina’s Secretariat of Mining, the global minerals market experienced significant volatility in March, reflecting a complex international backdrop shaped by macroeconomic uncertainty, geopolitical tensions, and shifts in trade policies among major global powers. Against this backdrop, Argentina’s Mineral Export Price Index rose 3% month-over-month, consolidating at historically high levels.

By Panorama Minero

This increase was mainly driven by the strong performance of gold, silver, and copper, which all posted sustained gains on international markets. In contrast, lithium carbonate prices continued to decline due to a global oversupply and weakening demand from key consumption markets.

Gold as a Safe Haven, Copper as a Strategic Asset

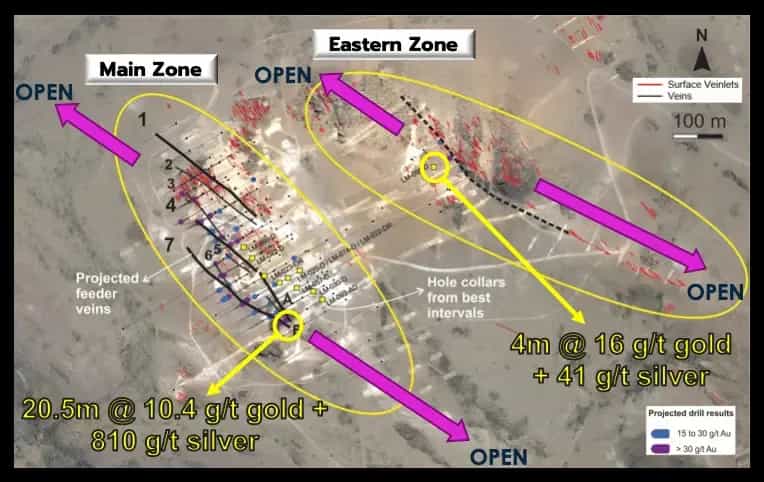

Amid growing risk aversion and expectations of potential adjustments in global monetary policies, gold reaffirmed its role as a safe-haven asset, hitting a new record of US$2,983 per troy ounce, up 38.2% year-over-year and 3.1% month-over-month. Silver followed suit, reaching US$33.2 per ounce, with a 35.4% annual increase and 3.2% monthly gain.

Copper—often seen as a bellwether of global industrial activity—benefited from economic stimulus measures in China and the anticipated implementation of trade tariffs in the United States. Additionally, a weaker U.S. dollar and tightening supply conditions drove copper prices to US$9,740 per tonne, marking a 4.4% monthly increase and a 12.1% year-over-year rise.

Lithium Moves Against the Trend

Unlike other metals, lithium saw a 3.8% monthly decline, deepening its annual drop to 28.8%, with average prices settling at US$9,447 per tonne of lithium carbonate. This downtrend stems from weaker demand in key segments—particularly the battery industry—and a sharp increase in global supply, notably from Asia and South America.

Outlook for Argentina

Despite the slump in lithium, Argentina’s mineral export basket continues to benefit from robust international prices for gold and copper, two of its flagship products. The price index remains above historical averages, offering a strategic window to boost foreign exchange inflows and advance ongoing mining projects.

The resilience of the index also highlights the need to diversify Argentina’s mining matrix and strengthen value chains around minerals that are critical to the global energy transition and infrastructure development.