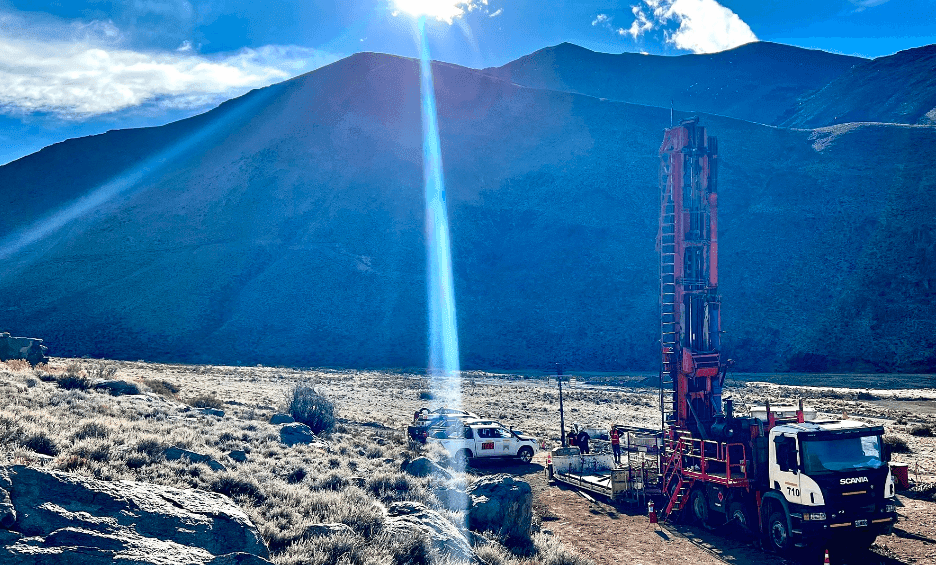

Minsud Resources Corp. announced the receipt of assay results from five additional drillholes, which were completed as part of the ongoing Phase IV infill and scout drilling program at the Chita Valley Project, San Juan Province.

By Panorama Minero

Drilling has resumed on the infill drilling program covering an area of approximately 2.5 square kilometres, for the purpose of generating a Mineral Resource Estimate on the Property. This area represents the primary mineralized zone within the Chinchillones target, as delineated through drilling.

From February 2024, continued drilling in Phase IV focused along the NE-trending corridor at the eastern end of the Chinchillones target. To date, Minsud has completed 8,856m in 14 drillholes during the first half of 2024. Assays have been received for drillholes CHDH24-99 to CHDH24-103, totaling 3,736.6m.

Hole CHDH24-102 was drilled with an orientation of 315°/-65° to a depth of 743.70 metres. Significant Drill Intercepts include 527.7m @ 0.26% Cu, 9.70 g/t Ag and 0.16% Zn, from 216m depth, including 8.0m @ 3.85% Cu, 188.60 g/t Ag, and 1.28% Zn, from 386.0m depth.

Hole CHDH24-103 was drilled with an orientation of 315°/-65° to a depth of 850 metres. Significant Drill Intercepts: o 384.0m @ 0.33% Cu, 5.85 g/t Ag, 85 ppm Mo, from 466.0m depth, including 15.0m @ 2.47% Cu, 0.22 g/t Au, 30.13 g/t Ag, and 0.159% Zn, from 548m depth.

Chichillones Infill Drilling Program Update

MSA continues the Chinchillones infill drilling program covering an area of approximately 2.5 square kilometres, for the purpose of generating a mineral resource estimate on the Property.

The program comprises 27,488 metres of diamond drilling, distributed in 32 drillholes. A total of 13 drillholes totaling 9,838 metres (CHDH23-86 to CHDH23-98) were completed by the end of 2023, while an additional 8,856m in 14 drillholes was completed during the first half of 2024, for a total of 18,694 metres completed to date in the infill program.

Completed 2024 Roadmap Items:

• Flotation metallurgical testing at ALS Kamloops is ongoing. These metallurgical tests are a prerequisite for a maiden resource estimate on the Chinchillones polymetallic deposit discovery.

• Terraspec. TIMA, micro-XRF and QXRD mineralogical studies have been completed in representative samples from the 2023 drillholes.

Ongoing 2024 Roadmap Items:

• Continuation of the remainder of the infill program of approximately 17,650 metres, expected to be completed by Q3 2024.

• Continuation of metallurgical testing on representative domains. Establish high, medium, and lowgrade domains for metallurgical and recovery testing.

• Continuation of mineralogical studies, Terraspec, TIMA, and QXRD on samples.

• Beginning in Q4 2024, continue with the development of new Exploration Targets identified during geological mapping surveys completed in 2023.

• Completion of an NI 43-101 resource estimate at the Chinchillones area within the Chita Valley Project by the end of Q4.

Current exploration activities on the Chita Valley Project are being funded by South32 Limited. On April 5, 2024, Minsud completed the issue to a wholly-owned subsidiary of South32 of a 50.1% shareholding in Minera Sud Argentina S.A. (“MSA”), Minsud’s indirect Argentinian subsidiary that holds and operates its flagship Chita Valley Project. The issue was made in accordance with South32’s earn-in right under the earn-in agreement dated November 1, 2019.