Regardless of having lower values compared to other metals, silver holds its appeal.

By Alejandro Colombo

Supply and Demand – A Deficit Market

Historically, the behavior of silver has had some correlation with that of gold: traditionally, the price of an ounce of silver follows that of the yellow metal. In this regard, and in parallel with gold, silver began its 2024 price around US$22. In May, the lows and highs were US$26 and US$32, and since September until the time of this report (second half of November 2024), it has not fallen below US$30, reaching records around US$35; since January, silver has appreciated by more than 40%.

A precious metal with different applications, demand is primarily driven by industrial uses. With a total demand of 1,021 Moz of silver in 2014, it has grown to 1,208 Moz in 2023: the industrial segment has increased from 450 Moz in 2014 to 655 Moz in 2023, clearly showing that this metal is finding more and more specific applications in the technological field. In this sense, green economies from the photovoltaic sector are reported, as well as the automotive sector, especially due to advancements in vehicle technology, along with continuous investments in charging stations.

Behind industrial applications, silver demand is also influenced by the investment and jewelry sectors. In the first case, a decrease is observed compared to previous years: 246 Moz in 2023 versus 337 Moz in 2022, due to a combination of lower consumption in the U.S. and Europe, offset by consumption from India. In the jewelry sector, the Asian giant is a critical player when observing consumption trends, with recorded values surpassing other countries combined.

In light of this, a deficit of 189 Moz in the market was observed for last year, in line with the 261 Moz in 2022 and 93 Moz in 2021. According to projections from the Silver Institute, the current year would also end in a deficit.

In terms of supply, no increases in mining production have been observed in the past five years: the year 2023 ended with a total of 829 Moz versus 839 Moz in 2022, reaching a decade-low of 784 Moz in 2020.

Supply - Key Players and New Actors

With the sole exception of 2020, when production was affected due to the pandemic, production has remained between 830 Moz and 900 Moz (approximately 23,500 and 25,500 tons) for the past decade.

Regarding 2023, the Silver Institute reported a mine production of 829 Moz, a slight decrease of 10 Moz compared to the previous year. The production increase from countries such as Chile, Bolivia, India, Brazil, and Kazakhstan was surpassed by the decline in other key producers such as Mexico and China – the world’s leading producers – as well as Australia, Russia, the U.S., and also Argentina.

Graph 1 shows that Mexico and China have substantially increased their production over the past decade, while historical producers such as the U.S. and Australia have seen declines, or have plateaued in the cases of Poland, Chile, and Peru.

Graph 1 – 2003 – 2023 Comparison of the Leading Silver Producers, Measured in Tons – (Source: USGS Geological Survey)

Graph 1 – 2003 – 2023 Comparison of the Leading Silver Producers, Measured in Tons – (Source: USGS Geological Survey)

Argentina – Present and Near Future

The Secretary of Mining of Argentina reported that silver production in 2023 decreased by 12.5% compared to 2022, from 29.6 Moz to 25.9 Moz, equivalent to around 100 tons, due to the cessation of operations at the Manantial Espejo mine (owned by Pan American Silver).

It is important to highlight that, in the mid-1990s, Argentina’s silver production was limited to the Aguilar Mine, as a byproduct of zinc and lead, with a production of less than 100 tons. The enactment of the Mining Investment Law allowed for greater silver production, both as primary metal – from the San José mine (Hochschild Mining) and the now-depleted Manantial Espejo mine (Pan American Silver) in the Santa Cruz province, and Puna Operations (SSR Mining) in Jujuy province – as well as byproducts from gold mining centers such as those in Santa Cruz (Cerro Vanguardia, Cerro Moro, Cerro Negro) and in San Juan (Veladero and Gualcamayo).

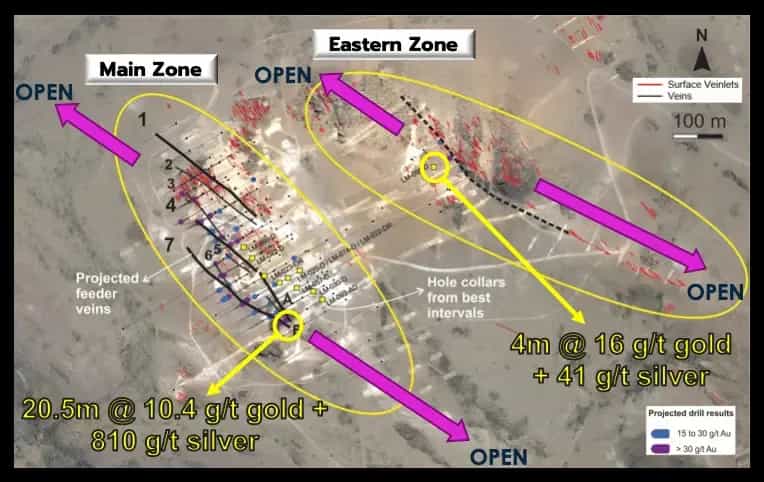

Argentina has several projects where silver is the primary metal; regardless of the stage of development of each project (Table 1), the Diablillos project stands out, ranking among the Top 10 undeveloped silver projects in Latin America. Already in its third drilling campaign, expanding the existing resource and showing encouraging metallurgical results, the project located in the province of Salta presents itself as one of Argentina's great mining promises, particularly in the silver sector.

Table 1 – Main Silver Projects – Source: Secretary of Mining of Argentina (September 2024)

Table 1 – Main Silver Projects – Source: Secretary of Mining of Argentina (September 2024)

The potential increase in silver production in Argentina could come from the production of some of the projects listed in Table 1, as well as byproducts from the start-up of gold and copper deposits.

In terms of foreign trade, silver accounted for 17% of the total (US$695 million out of a total of US$4.060 billion), showing a marked decline compared to previous years (20% in 2022, equivalent to US$802 million out of a national total of US$3.857 billion; 24% in 2021, representing US$805 million out of a national total of US$3.243 billion; 23% in 2020, with US$591 million out of a national total of US$2.620 billion).

What does silver mean in the exploration context of Argentina? Silver represents the lowest proportion among the four main pillars of Argentina's mining sector – gold, copper, lithium, and silver – a trend observed throughout the last decade. In 2023, it accounted for only 9%, equivalent to about US$38.6 million.

The national mining authority has reported a resource of 2,296 Moz of silver, identified from 7 projects, some of which are in advanced stages of development. The total estimated CAPEX for the development, construction, and start-up of new projects, as well as the expansion of existing operational centers, is estimated to be around US$1.3 billion.