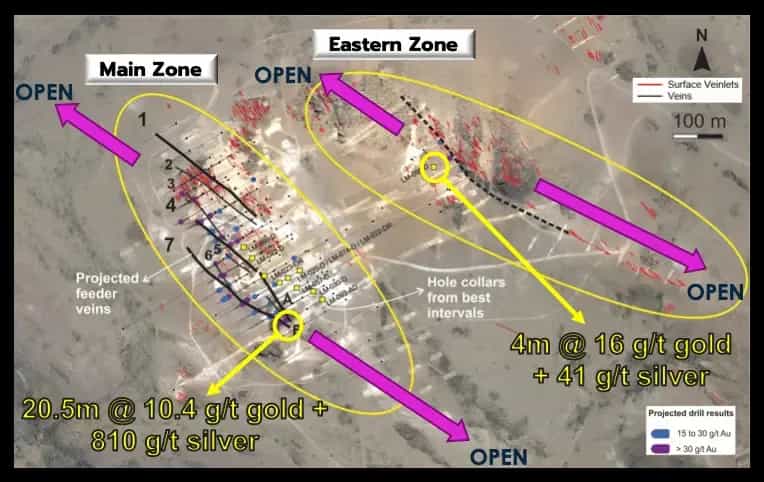

The lithium company, which is set to be acquired by Rio Tinto, reported third-quarter revenues of US$203.1 million, with attributable net income of US$16.1 million and adjusted EBITDA of US$42.9 million. Despite a decrease in volumes and market prices for certain products, the company managed to maintain an average price of US$16,200 per metric ton of lithium. This figure represents a slight decline from the previous quarter, driven primarily by weaker demand and delays in the lithium carbonate production expansion at the Olaroz project in Argentina.

By Panorama Minero

Arcadium’s strategy for the third quarter focused on maintaining competitive prices through long-term commercial agreements, particularly in lithium hydroxide, allowing it to uphold profitability in a challenging market. According to Paul Graves, CEO of Arcadium Lithium, the focus on strategic customer agreements enabled the company to achieve an annual average price of US$18,000 per ton, outperforming market indices.

Acquisition by Rio Tinto

On October 9, Arcadium Lithium announced its acquisition by Rio Tinto in a transaction valued at US$5.85 per share, representing a 90% premium over the October 4 closing price and valuing the company's equity at approximately US$6.7 billion. This transaction, expected to close by mid-2025, was unanimously approved by the boards of both companies and remains subject to Arcadium Lithium shareholder approval, the Royal Court of Jersey, and customary regulatory clearances.

Paul Graves, CEO of Arcadium Lithium, stated that this transaction "represents a fair value and enables our shareholders to mitigate market risks, thereby ensuring the expansion of our strategy for the benefit of customers and communities."

Arcadium Lithium will continue to report quarterly results until the acquisition is finalized.