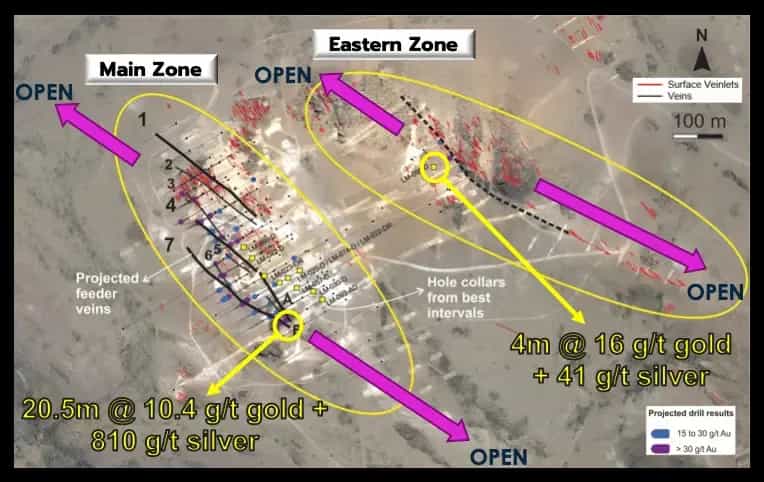

In a move that reinforces their position in the global mining industry, BHP and Lundin Mining have completed the acquisition of Filo Corp., a company listed on the Toronto Stock Exchange and the owner of the Filo del Sol (FDS) copper project, located in the Vicuña district between Argentina and Chile. This step marks a key milestone in the expansion of both giants in the copper market, a critical mineral for the energy transition and global technological growth.

By Panorama Minero

The transaction, which includes the creation of a joint venture named Vicuña Corp., combines the resources of the Filo del Sol project and the Josemaría project, also located in the district. BHP and Lundin Mining each hold a 50% stake in this new entity, which will be managed independently by Vicuña Corp., ensuring operations aligned with international industry standards.

The agreement involves a total payment by BHP of US$2 billion, including a US$690 million contribution to Lundin Mining for a 50% interest in the Josemaría project. Both parties have integrated their respective stakes in Filo Corp. and Josemaría into Vicuña Corp., consolidating a strategic portfolio that promises long-term value for shareholders and local communities alike.

Impact on the Copper Market

As highlighted by BHP CEO Mike Henry, this alliance represents a significant growth opportunity. “We are pleased to partner with Lundin Mining in the Vicuña joint venture, which combines complementary capabilities to develop projects with a sustainable and high-impact approach. The growing demand for copper, driven by the energy transition and the development of technologies like artificial intelligence, underscores the importance of this metal for the future of the global economy,” Henry stated.

Financial and Structural Details

The acquisition of Filo Corp. was approved by shareholders in September 2024, with a total valuation of C$4 billion. Of this amount, BHP contributed C$2 billion (US$1.4 billion) in cash, at a price of C$33 per share. Lundin Mining, for its part, contributed C$877.8 million in cash and 94.1 million of its own shares.

The agreement establishes an equitable governance model for the new joint venture. Both BHP and Lundin Mining will have equal voting rights on the board of Vicuña Corp., ensuring balanced decision-making in strategic matters.

With these announcements, the Vicuña region is cementing its position as a key hub for copper mining in South America, supported by the potential of these projects to generate employment, economic development, and significant contributions to global supply chains. This strategic move underscores Latin America’s growing prominence in supplying essential resources for the world’s energy and technological future.