The Ministry of Mining of the Nation and the governors of Salta, Jujuy, San Juan, and Catamarca presented the Argentine mining asset as a de-risking factor at the First Argentine-German Meeting on Critical Minerals in Berlin. Sovereign guarantees, financial instruments, and specific funds for the development of new investments in Argentine mining were the focus of the business day.

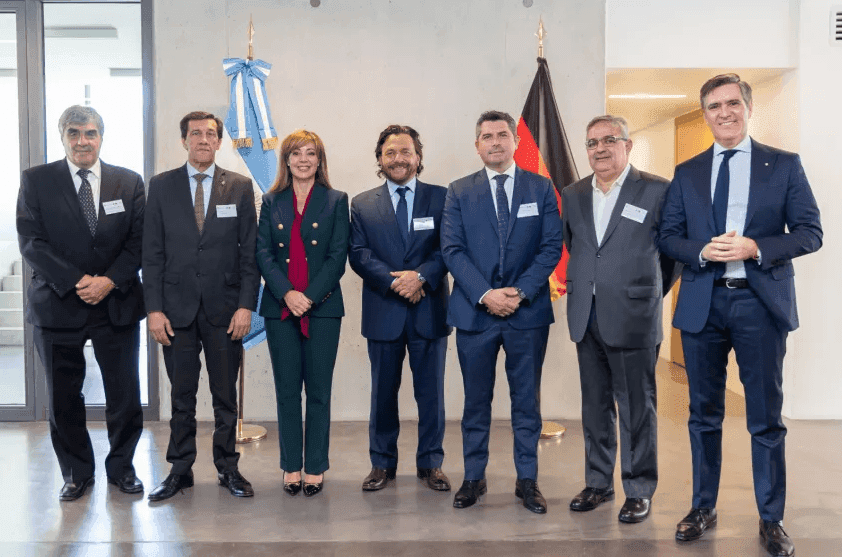

On Thursday, the 1st Argentine-German Meeting on Critical Minerals took place at the Argentine Embassy in Berlin. Flavia Royon, Secretary of Mining of the Nation, along with Governors Carlos Sadir of Jujuy, Gustavo Sáenz of Salta, Raúl Jalil of Catamarca, and Marcelo Orrego of San Juan, were present in the German capital with a delegation of Argentine companies, Roberto Cacciola, president of the Argentine Chamber of Mining Companies (CAEM), and virtually, Eduardo Marquina from the Geological Mining Service (SEGEMAR), presented the capabilities of our country as a safe, reliable, and sustainable supplier of the mining industry and critical minerals to a live audience of over 140 investors, politicians, and representatives from the mining sector and German energy transition.

The business day, organized by the Argentine Embassy in Germany, the Argentine Ministry of Foreign Affairs, and the Ministry of Mining of the Nation, along with the German Association of Raw Materials and Mining Abroad (FAB), the German Federal Institute for Geosciences and Natural Resources (BGR), and the German Agency for Mineral Resources (DERA), aimed to present Argentine assets to integrate into the global energy transition chain through its resources and technical and human capabilities, and to consolidate Argentina as a safe and sustainable supplier for the German and European markets through the addition of Argentine value to the mining and critical minerals industry.

The Argentine delegation included the Argentine Chamber of Mining Entrepreneurs (CAEM), companies such as McEwen - Los Azules Project; Lithium Argentina - Plant in Cauchari-Olaroz and Cauchari Olaroz Stage 2 and Pastos Grandes project; and Integra Capital - Lithium projects in Jujuy, Salta, and La Rioja, Jama project, and the new acquisition of Los Helados and Lunahuasi projects.

The companies presented their main projects in Argentina to German and European investors and financial funds in an investment pitch. Virtually, Pan American Energy and its new lines of work with lithium mining projects, Litica Resources, lithium projects in Jujuy and Salta, particularly highlighting the Rio Grande project in the Salta Puna, First Quantum - Taca Taca copper project in Salta, Lundin Mining - Jose Maria project, and Lake Resources - Kachi Project in Catamarca also participated.

The meeting showcased to the German market, eager to diversify suppliers in critical sectors linked to the transition, the determination of the Argentine provinces to integrate into each segment of the global value chain of copper, lithium, and batteries, highlighting that all studies confirm that in the short term, Argentina will become the third-largest lithium producer globally. To achieve this, the national government, as well as the provincial governments, are already working to consolidate a productive dynamic that, through private investment, promotes value chains of this mineral through technology transfer, improved standards and environmental sustainability practices, and contracts to finance the construction of projects with guarantees in copper and lithium products.