Fortuna Silver Mines has provided its latest Mineral Reserve and Mineral Resource estimates as of December 31, 2023 for its five operating mines in West Africa and the Americas, as well as the Arizaro project, part of the Lindero mine located in Salta and operated through its subsidiary Mansfield Minera SA, in Argentina.

By Panorama Minero

The Lindero mine had Proven and Probable Mineral Reserves of 71.5 Mt, containing 1.3 Moz of gold, in addition to Measured and Indicated Resources, excluding Mineral Reserves, of 30.5 Mt containing 412 koz Au, and Inferred Resources of 25.3 Mt with 386 koz Au.

Since December 31, 2022, Mineral Reserve tonnes decreased by 10% at the mine, while the gold grade remained relatively unchanged at 0.56 g/t Au. Changes are primarily due to mining extraction and sterilization of 6.5 Mt of material containing 122 koz Au delivered to the heap leach pad in 2023, alongside an increase in the cut-off grade due to higher operating costs, resulting in a decrease of 2.3 Mt containing 21 koz Au.

"The gold ounces of Measured and Indicated Resources, excluding Mineral Reserves, remained relatively unchanged year after year," stated the operating company.

Meanwhile, Inferred Resource tonnes increased by 1.1 Mt, or 5%, to 25.3 Mt since December 31, 2022, with the gold grade remaining unchanged at 0.47 g/t. The slight increase in Inferred Resources is due to minor adjustments in the optimization of the pit shell.

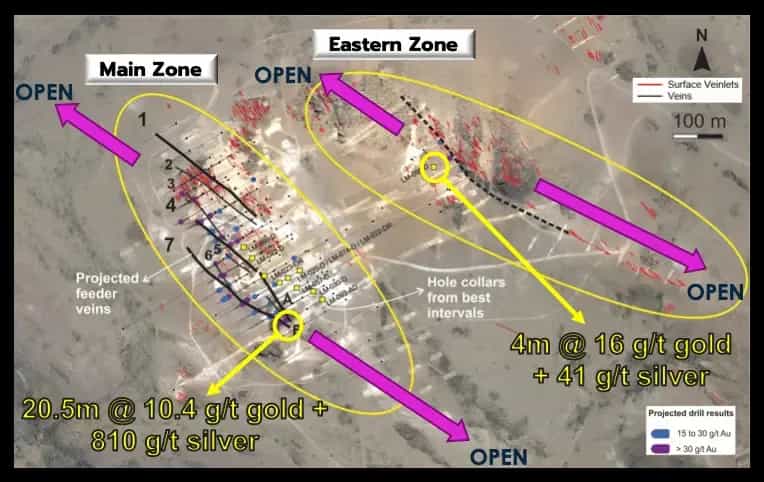

Arizaro Gold Project

As of December 31, 2023, the Arizaro gold project, part of the Lindero mine property, had Inferred Mineral Resources of 24.1 Mt with an average of 0.40 g/t Au, containing 310 koz of gold, remaining relatively unchanged from the previous year, except for minor adjustments in the pit shell. Mineralization remains open at depth and along the trend of the northeast to southwest striking porphyry.