Lithium Argentina (LAAC), formerly Lithium Americas Corp, announced the results for the fourth quarter and full year of 2023, as well as its outlook for 2024.

By Panorama Minero

Among the corporate highlights, the company reported the appointment of Sam Pigott as President and CEO, while endorsing John Kanellitsas as its Executive Chairman. Additionally, they highlighted the agreement with Ganfeng Lithium, confirming a $70 million investment to acquire a 15% stake in the Pastos Grandes project in Salta, through a share subscription of the company's Argentine subsidiary, named Proyecto Pastos Grandes S.A. This transaction, supported by Lithium Argentina, will include the preparation of a regional development plan for the Pastos Grandes basin and surrounding properties, with an expected completion date by the end of 2024. This transaction is expected to close in the second quarter of 2024.

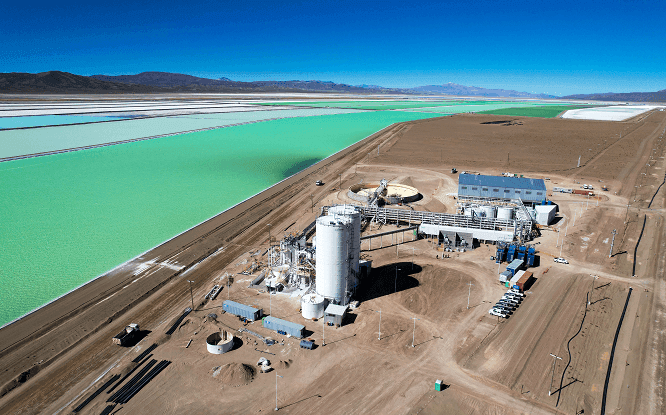

On the operational front, LAAC emphasized the commencement of production at Caucharí-Olaroz, considered the largest green lithium brine project and the most recent to enter this stage. During 2023, the company achieved production of approximately 6,000 tons of lithium carbonate with a purity of 99.5% and meeting high-quality technical specifications. Currently, Caucharí-Olaroz is operating at approximately half of its annual capacity of 40,000 tons, with the aim of reaching nominal production capacity on a limited basis by mid-2024 and maintaining a level close to capacity in steady-state by the end of the year. Production of 20,000 to 25,000 tons of lithium carbonate is projected for Caucharí-Olaroz in 2024; and given the current price environment, the project is anticipated to generate positive cash flow during the year.

Financially, as of December 31, 2023, Lithium Argentina had $122 million in cash and equivalents. Additionally, the company has $259 million in convertible debt with an interest rate of 1.75%, maturing in early 2027, and has not yet utilized its $75 million credit line with Ganfeng. On the other hand, Minera Exar S.A., the Argentine joint venture in which Lithium Argentina holds a 44.8% stake, along with Ganfeng (46.7%) and Jujuy Energía y Minería Sociedad del Estado (8.5%), has approximately $234 million in local debt related to working capital financing and start-up costs. In this regard, the company is in the process of finalizing new credit lines with Ganfeng to refinance a significant portion of this local debt, with long-term credit facilities more typical of an operating business.

Commenting on the results for the twelve-month period ended December 31, 2023, John Kanellitsas, Executive Chairman of Lithium Argentina, added: "Last year was significant for Lithium Argentina, with the start of operations at the Caucharí-Olaroz site. This achievement was the result of years of hard work, dedication, and determination, and an investment of over $1 billion in northern Argentina. I am proud of the multicultural team that came together to diligently progress at Caucharí-Olaroz, making it the success it is today. Additionally, last year Lithium Argentina closed the acquisition of our majority stake in the Sal de la Puna project and completed the spin-off of our assets in North America in a strategic move that ensures its future in the market. I am confident that the great work done to date will be the foundation for great achievements for the company."

For his part, Sam Pigott, CEO of Lithium Argentina, commented: "Following the achievements made, I am eager to work with this team to take the company to the next level. Looking ahead, the priority is to complete the commissioning of Stage 1 of Caucharí-Olaroz and transition from development to operations. The project is on track to complete commissioning and is currently producing at approximately 50% of its capacity, already making it one of the largest operations in Argentina. The operation aims to achieve nominal production capacity on a limited basis by mid-2024 and maintain a level close to capacity in steady-state by the end of the year. Although the project commissioning has gone very well, we will continue to be mindful of the market environment and make thoughtful decisions to ensure shareholder value is protected."

"The recent agreement to prepare a regional development plan with Ganfeng for its Pozuelos Pastos Grandes project and Lithium Argentina's Pastos Grandes and Sal de la Puna projects is a potentially beneficial opportunity to organize the development of these assets logically and maintain the optionality. LAAC's strong financial position, along with the high quality and low cost of its brine assets in Argentina, will position it better to navigate the lithium market cycle today and in the future," Pigott concluded.

Lithium Argentina announces operational results and outlook for 2024