Barrick Gold Corporation announced preliminary production for the first quarter of 940 thousand ounces of gold and 40 thousand tons of copper, along with preliminary sales of 910 thousand ounces of gold and 39 thousand tons of copper for all its operating mines. The company expects gold and copper production to increase progressively each quarter throughout the year, with the expansion of the Pueblo Viejo plant in the Dominican Republic increasing from the second quarter and the reactivation of the Porgera mine in Papua New Guinea continuing as planned. "We remain on track to achieve our annual projections for gold and copper.”

By Panorama Minero

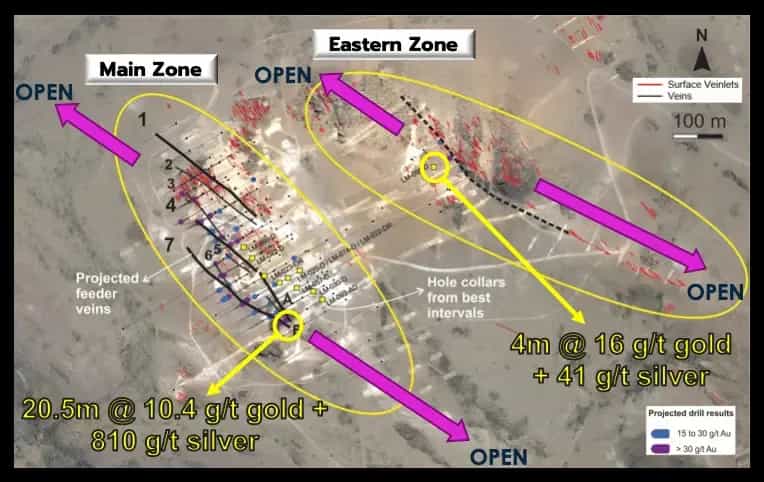

In Argentina, Barrick Gold Corporation reported production for the first quarter of 2024 of 57 thousand ounces of gold, corresponding to 50% of its stake in Veladero, a mine it operates with its Chinese partner, Shandong Gold. In addition, Barrick announced sales of its production in San Juan for 33 thousand ounces of gold during the last three months, at an average market price of US$2,070 per ounce.

Gold production in the first quarter was lower than in the fourth quarter of 2023, mainly due to scheduled maintenance at one of its mines and the mining sequence at several of its operations. According to the company's plans, as a result of lower production, it is expected that sales costs per ounce of gold for the first quarter will be 4% to 6% higher, total costs per ounce of gold will be 6% to 8% higher, and total sustaining costs per ounce will be between 7% and 9% higher compared to the fourth quarter of 2023. "Costs are expected to decrease in subsequent quarters of the year as production increases," the company said in the statement.

Meanwhile, preliminary copper production for the first quarter was lower than in the fourth quarter of 2023, mainly driven by lower mineral grades extracted at Lumwana in Zambia. Compared to the fourth quarter of 2023, due to lower production and according to plans, it is expected that sales costs per pound of copper for the first quarter will also increase and be 9% to 11% higher, cash costs per pound will be 10% to 12% higher, while total sustaining costs per pound will be 14% to 16% higher.