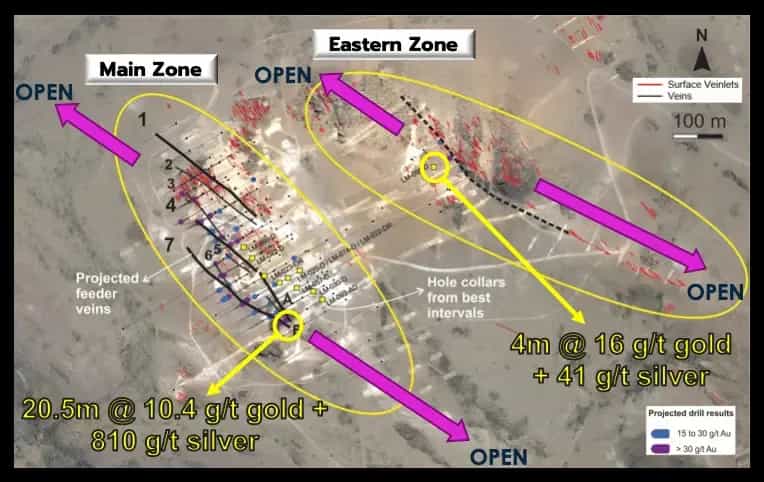

The company that owns the gold mine has announced the start of a new exploration campaign in Santa Cruz, with the goal of extending the mine's life and increasing mineral resources.

By Panorama Minero

Cerrado Gold has commenced an initial drilling phase of approximately 3,000 meters, focused on two key high-grade targets: the Goleta zone and the northern depth extension of the Calandrias section. The drilling aims to provide additional high-grade material for the cyanide leach (CIL) plant.

Currently, a drilling rig has been mobilized to the site and is drilling the first hole at Goleta. Any new resources would contribute to the recently completed mineral resource estimate by the company, announced on August 6th, which projects a mine life of five years and a Net Present Value (NPV) of $111 million at a gold price of $2,100 per ounce ($153 million at $2,400 per ounce).

Mark Brennan, CEO and President of Cerrado Gold, commented: “With a period of uncertainty now behind us, we are excited to begin a new exploration program at MDN, where we see the potential to significantly expand the resource base beyond the five-year mine life outlined in the recent PEA. This new program is particularly focused on the potential to rapidly increase high-grade resources suitable for processing at the CIL plant and thus extend the mine's life. This initial round of drilling is designed to support future programs as the company rigorously explores our extensive land package.”