Global volatility and its effects on Argentina were the central theme of JP Morgan’s analysis at the region’s largest lithium conference. The country's mining potential, fully influenced by international circumstances, and the need for swift decision-making on the domestic front.

By Panorama Minero

At the XIII South American International Lithium Seminar, Lucila Barbeito, Executive Director and Economist for Argentina, Uruguay, Paraguay, and Ecuador at JP Morgan, along with Carlos Christensen, Vice President of Subsidiary Banking for Argentina, Bolivia, Paraguay, and Uruguay, provided a comprehensive perspective on the global economic scenario and its direct impact on Argentina. The specialists emphasized the importance of the U.S. elections and China’s evolution for Argentina and warned about the need for structural reforms and greater macroeconomic stability in the country.

A soft landing, but with nuances

Barbeito expressed optimism regarding a "soft landing" for the U.S. economy, with gradual reductions in interest rates. However, she pointed out that “the risk is tilted towards U.S. inflation not slowing down as quickly as expected.” This situation could lead the Federal Reserve to adopt a more restrictive stance, which in turn would affect emerging markets.

The U.S. elections were also a central point in JP Morgan’s experts' analysis. "A Trump victory would generate more volatility and uncertainty in the markets," warned Barbeito. On the other hand, a Biden victory is expected to maintain a more consistent approach.

China’s role and its impact on Argentina

The economist also highlighted the importance of China for the global economy and, in particular, for Argentina. "The slowdown in China's growth is a concern," she noted, but emphasized the Chinese government’s efforts to stimulate the economy.

Argentina: Challenges and opportunities

Regarding Argentina, Barbeito highlighted the progress made in terms of fiscal consolidation but warned about the need to continue working on macroeconomic stabilization and implementing structural reforms. “The main challenge is the sustainability of policies over time,” she said.

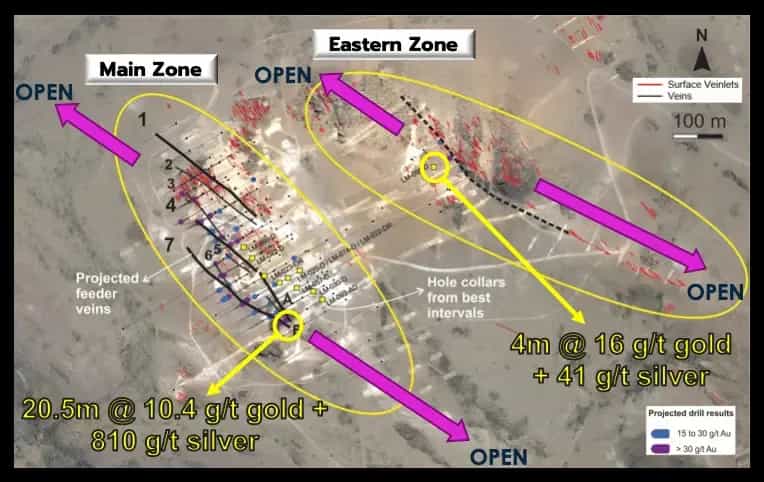

The economist expressed optimism about Argentina's medium-term growth potential, especially in sectors like energy and mining. However, she stressed the importance of advancing toward a unified exchange market and strengthening international reserves.

"Argentina’s medium-term potential is enormous," Barbeito stated. "But successful macroeconomic stabilization and structural reforms are needed."

Finally, the specialists highlighted the importance of closely monitoring the FED’s monetary policy, the outcome of the U.S. elections, and the evolution of the Chinese economy. For Argentina, Barbeito underscored the need to continue advancing in structural reforms and seizing the opportunities offered by the growing global demand for minerals like lithium.